In this month in 1899, the British signed a 99-year lease for the 400 square mile area known as Hong Kong. As we all know, at the end of the lease, the property reverted back to China. But there was an ageless lesson from this fact: be very careful when you enter into a contract. Often, that which is assumed to be subject to discussion at the end will instead be litigated. The British probably assumed an extension to the agreement would be possible when it expired (remember that Hong Kong was not as important an area in 1899) but they should have included the right of renewal in that first agreement. We are big believers in the fact that everything about every deal should be in writing. Leaving things up to discussion only leads to problems. If you are contracting to buy a self-storage facility and you want to make sure that that the riding lawnmower comes with the property, then put that in writing. Playing fast and loose is often a recipe for disaster, as even the nicest people can become difficult when it relates to money. A good contract includes every possible contingency.

Memo From Frank & Dave

Real Gold Or Fool’s Gold: The Importance Of Due Diligence

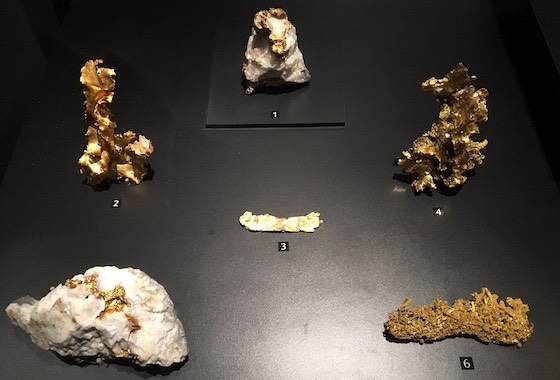

“Fool’s Gold”, also known as the mineral pyrite, looks like real gold. Yet real gold is valued at around $1,200 per ounce, while “fool’s gold” is valued at -0-. Many a miner has been hugely disappointed when the fruit of their labor turns out to be just a bag of pyrite and not a fortune in real gold. So how can you tell if your self-storage potential acquisition is real gold or fake gold?

Regional information

The first driver to value of a storage facility is the macro region of America that it’s located in. Like it or not, there are a few key regions that are considered more valuable than others, namely the Southwest, Northwest, and Northeast. This is typically because of higher population densities and higher disposable incomes that result in greater numbers of items to store. But there are also micro-regions that are hot, such as Texas and Florida, and well as certain cities that are unusually strong, such as Des Moines. The point is that to have a truly valuable storage facility, it helps to be in a highly valuable market. This information can be gleaned from such websites at www.bestplaces.net and Wikipedia.

Market information

To know if the potential storage property is of high value, it’s important to be an expert on the market itself. You should know how many storage facilities there are in the market, what age and style they are, and what the occupancy is. Given this type of data, for example, you would immediately find that a property in San Francisco is a much higher gold quality than one in Sacramento.

Comps

You also need to know the exact rent comps of every facility in the market, as well as what their specials are. Your potential acquisition can quickly turn from gold to fool’s gold if it turns out the rents are higher than market. To accomplish this, you need to mystery shop all of the properties that come up under the simple Google search “self-storage in [name of city]” and then cross-reference this list against a map to see where these are in relation to your property.

Review of current operating numbers

While you may have plans to improve operations, at this point the only factual evidence you have of gold or fool’s gold is the actual past operating numbers. You must get a copy of these for the prior three years, as well as tax returns (if the seller will provide these – some refuse the tax return request). Look at these number and try to “normalize” them by removing unusual one-time charges and adding back in things that would typically happen in a certain year.

Verify each line item

Don’t just take the seller’s word for it – drill down on each line item and verify it. You can get the actual print-outs of utility costs from the utility companies, and the actual property tax data needed to calculate the tax at the purchase price. In fact, there’s nothing you can’t verify, right up to counting the occupied units (assuming that a lock on the door is evidence of it being rented). Because the seller is going to get a multiple of the net income in the purchase price (like 10 to 1 or higher) they are prone to cheat at every possible turn. Your golden deal will turn to fool’s gold if you let them outsmart you. And not doing due diligence is a roadmap to destruction.

Get other opinions

It never hurts to get other opinions on your potential acquisition. An appraisal is good. Talking to other storage owners in the area can sometimes provide valuable information. Talk to industry associations. Talk to your banker, your neighbor, anyone who has good common sense. The more eyes that look at the deal, the better your chance or it being real gold and not fool’s gold.

Gut instinct

Here’s a big one that few people discuss: gut instinct. The innate human ability to sort millions of pieces of data and deriving a “good” or “bad” feeling. If you have a “bad” feeling, then it may well be fool’s gold. Don’t forget that the human brain is still far superior to the computer in mapping out incoming data bytes into the big picture. Trust your instincts.

Conclusion

There’s no better feeling than buying a storage deal that it pure gold, and none worse than buying fool’s gold. Take these steps to ensure that you are never disappointed.

Self Storage Home Study Course

Our Home Study Course is not like anything you have ever listened to or read before. We do not fill it with a bunch of fluff on how your are going to make a million bucks with no money down. We tell you the whole story... the good, the bad, and the sometimes ugly.

Click Here for more information.

What Gives A Self-Storage Facility “Good Bones”

When looking at a self-storage acquisition, you sometimes have to look beyond what’s on the surface and delve deeper into the basic nuts and bolts of the deal. These most basic attributes of a facility are called “bones”. So how can you tell if your deal has good “bones” or not.

Unit size

The standard desirable unit sizes for a self-storage facility are 5’ x 5’, 5’ x 10’, 10’ x 10’, 10’ x 20’ and 20’ x 20’. If the proposed property has funky “custom” sizes such as 7’ x 28’ or 2’ x 9’, then be careful, as this will cause big problems in two areas: 1) competing with the more desirable and standard layouts and 2) the ability to sell some day to Public Storage or another institutional owner, who prefers things to be the same throughout their portfolio.

Unit mix

Most successful storage facilities have a healthy mix of units to fit the needs of a wide range of customers. This makes total sense, as the items that people are wanting to store are completely unique to them and this requires a selection of appropriate unit sizes. However, there are some facilities that just have one type of unit, or 90% of one type. This would definitely not be a sign of having good “bones”.

Number of units

The most desirable facility size is around 400 units. This allows for a good management team, a healthy amount of inventory, and a strong position in the market. It’s also the type of size that bigger players seek when it comes time for you to sell down the road. While people have done well with much smaller properties, when it comes to the best “bones”, the larger properties are favored for their potential for institutional investment by REITs in the future.

Location

Real estate is all about “location, location, location” and self-storage is no different. If you want to have a facility with good “bones” it will need to be in an attractive market. We all know that one of the big drivers to market strength is population size, so bigger cities are definitely preferred over rural areas. You literally can never be in an area that is “too big” but you can definitely be in an area that is “too small”. Population increases in that market also help, as opposed to decreases.

Market comps

A facility with “good bones” also relies on the neighboring facilities to be healthy and offering solid pricing. This is one attribute that needs somebody else to help in order to reach full potential. Even if you’re the best storage operator in the world, you cannot succeed if everyone else is giving away their units.

The price you pay

Just like calcium leads to good bones, your economics in the deal relates to its bone structure. If you pay a reasonable amount and then ramp up the marketing and push rents and occupancy, you will have good bones. Those properties in California that trade at 4% cap rates may look pretty, but they make absolutely no profit, so their bones are not good. Remember that beauty is only skin deep, and we’re talking bones here.

Conclusion

For the best success, focus on buying properties with good “bones”. These have unlimited potential, and are the strong foundation you need for investment success in the self-storage sector.

The Ways The Internet Has Changed Self-Storage

There is no question that the advent of the internet era has changed America. Some industries have prospered while others have been destroyed. Self-storage has done well, but there is no question that the business model has changed as a result of the internet. So how has the industry evolved in the internet era, and how has that created opportunity?

Greater exposure

Prior to the internet, storage facilities with larger marketing budgets were able to dominate markets, with ads on everything from transit benches to newspapers, yellow pages and direct mail. However, the internet leveled the playing field and now a small facility can show up on a simple Google search as well as a giant Public Storage offering. It was said that “God made men but Colt made them equal”, and in this case the internet made storage owners equal.

More targeted marketing dollars

The internet allows self-storage owners to use their ad dollars more effectively. They can reach their targeted customers, and measure the results in real time. This has allowed owners to function on lower budgets and also opened the door for smart marketers to conduct “guerrilla” marketing ventures to gain rapid market share. While newspapers across America bemoan the loss of ad revenues, self-storage owners have greatly profited from less waste.

Amazing turn-around possibilities

A large number of self-storage owners have made huge amounts of money by utilizing the internet to quickly and effectively turn-around under-performing facilities. If you buy a property today with low occupancy or low rents, you can launch a virtual internet marketing barrage to boost both in a very short amount of time. Those who turn-around storage properties are able to use the internet as the ultimate financial weapon.

More aggressive pricing options

With the internet, you can now launch and test move-in specials in real time and at much lower cost. You can literally turn on and off specials like a spigot, based on vacancy and market conditions. In the old days, it took weeks for ads to run and you could not turn them off until after the contract expired. Today, the internet has made this effort amazingly easy to manipulate.

More price shopping by customers

Of course, this is the one downside of the internet – the ability for customers to price shop right on their laptop or cell phone. This freedom of consumer choice benefits those that are strong marketers, and hurts those who are not. If you are in the latter category, you need to get up to speed on internet marketing immediately. You can find resources for this on-line, or at least talk to a millennial who grew up on the internet and knows how to make it work for you. Hiding from the reality of the internet era is not a successful option.

Conclusion

The internet has been a terrific invention for self-storage owners – at least those that know how to use it effectively. If you are not in that category, seek help immediately.

How Self-Storage Proved It Was Not A Fad

Drive-in movies were a big hit in the 1950’s, with over 4,000 drive-in theaters across the U.S. The one pictured above is just south of Memphis, Tennessee, and now sits completely abandoned. Some industries are fads and others are a permanent fixture. So how has self-storage proved it is not a fad but instead a part of mainstream real estate?

The leadership of Public Storage

The storage industry would not be what it is today if it was not for the leadership of B. Wayne Hughes, who founded Public Storage in 1972 and grew it to 1,000 locations by 1989. Public Storage is the largest owner of self-storage in the world, with over 2,200 facilities throughout the U.S. The industry has also benefited by the efforts of the other REIT owners such as Extra Space and Life Storage. These large owners have created a sense of respectability on Wall Street for the sector, and that has resulted in lower cap rates, higher appraisals and easier bank financing.

Strong absorption

The first sign of a fad is the rapid demise in occupancy as customers lose interest. However, self-storage has posted strong occupancy numbers for decades now, and the possibility that it is a fad has been extinguished. The shelf life of a fad is just a few years, but storage has been going strong for nearly half-a-century.

Performance after the Great Recession

Many critics said that storage had never been tested in a severe downturn in the U.S. economy, as the industry began in the 1970s and had never seen truly bad economic times. The critics said that in a depression the customers would sell their goods on eBay and immediately cancel their storage contracts. Well, that supposition ended in 2007 with the advent of the Great Recession. And the ending was epic: storage occupancy actually increased as people choice to store their stuff while they sought new jobs or more stable housing options.

Conclusion

Unlike the drive-in movies sector, self-storage is not a fad ad will never fall into obsolescence. The industry has been tested by recession and time, and has fared very well indeed.

Brought To You By SelfStoragesUniversity.com

If you need more information please call us (855) 879-2738 or Email [email protected]