On September 4, 1609 the Island of Manhattan was discovered by navigator Henry Hudson. And on September 4, 1781, Los Angeles was founded by the Spanish Governor of California, Felipe de Neve. In both cases, nobody much cared. Does that mean that September is the official month of missed opportunities? No, because real estate is all about timing. It took nearly 200 years for investing in Manhattan to be profitable, and John Jacob Astor saw that opportunity. And Los Angeles meant nothing until the advent of the movie industry 140 year after it was founded. The bottom line is that anyone can look back in hindsight and say “that was a great opportunity” but smart storage investors know that there’s a time to buy and a time to sell. Some storage markets in the U.S. appear oversaturated and have declining occupancy, thanks to far too much new development. Those markets should be avoided unless the economics of the deal warrant the risk. Still other markets are still healthy. Those should be sought out. The key is to stay alert to trends and not fight the data but embrace it and make your decisions accordingly.

Memo From Frank & Dave

Key Points to Maximizing the Financial Performance of Your Storage Facility

Every storage property is no different than a car – they all have an engine with a certain amount of horsepower. The car runs on gas and the storage facility runs on cash. But, just as a mechanic may do with an engine, the storage investor is always trying to figure out ways to enhance the inherent horsepower, or in this case net income. So how can you increase your storage property’s financial performance?

Defining what creates maximum financial performance

Self-storage investing – and all real estate – revolves around sensible leverage. The typical debt level on a storage property is 70% to 80% Loan-To-Value (LTV). It is this leverage that’s a key component on deriving high rates of return called “cash-on-cash” – effectively the total return on your down-payment. What fuels high levels of return is the “spread” between the interest rate on the loan and the cap rate on the deal. So to really spike performance, there are three features: 1) pushing revenue 2) cutting costs and 3) maximizing debt.

Maximizing revenue

It sounds simple, but the truth is that you can never, ever, be 100% maximized. You can always push the rent a little higher and add one more offering that is revenue producing. The typical ways to maximize revenue are to: 1) raise rents to full market level 2) increase occupancy to 100% and 3) to add on services such as sales of packing materials and locks and even U-Haul offerings. But smart operators know that they should always be watching for additional revenue enhancements that may be emerging – you should be a voracious reader and student of all the ideas around you.

Minimizing expenses

Every storage operator should, on a monthly basis, look at their expenses and compare them to budget to look for areas that are higher than anticipated. But they should also review each line item and see if they can come up with three outside-the-box ideas to cut it down even more. You would be amazed at what you can come up with when you take the mental exercise seriously. And you will also be impressed at the savings possible when you simply renegotiate even trivial items like your trash expense.

Maximizing debt

For many storage owners, this can be the key to unlock the biggest single spike in property performance. When was the last time you refinanced? What is your interest rate? Rates go up and down, and they may now be lower than your existing debt. Or perhaps you have created equity with higher rents and occupancy and your loan is not at 70% to 80% LTV but instead now at 60%. Reorganizing your debt can often give you a huge jump in performance.

Or – in some cases – simply sell the property

If you have truly maxed out the net income on the storage property, you might be able to boost your yield simply by selling it at a good price and reinvesting the money in another storage facility. The fact is that there is a rule of economics called “opportunity cost” which basically means that every dollar you have invested in one property is taking that dollar away from being in another property. If your current cash-on-cash return is 10% -- and there is another property out there that could hit 12% -- then you are being foolish holding on to the original property instead of re-deploying.

Conclusion

Like a Lamborghini, storage properties also have a shot at high performance. It’s the job of all smart owners to work aggressively to maximizing yields whenever possible.

Self Storage Home Study Course

Our Home Study Course is not like anything you have ever listened to or read before. We do not fill it with a bunch of fluff on how your are going to make a million bucks with no money down. We tell you the whole story... the good, the bad, and the sometimes ugly.

Click Here for more information.

How Simple Games Can Improve Staff Morale

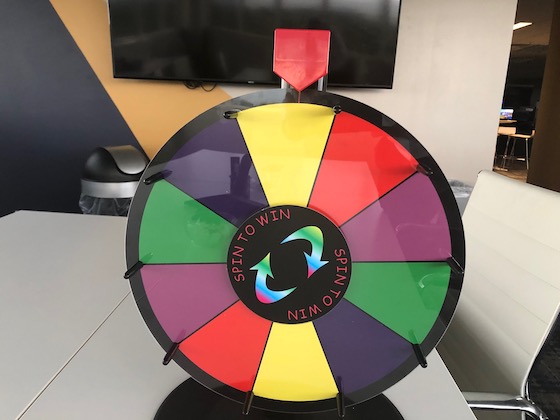

This is a “game show” styled spinning wheel that we keep in the office as part of some of the games we do to improve company morale. We are a big believer that you can really motivate your staff by engaging in perpetual competition of all types. Why do these endeavors work so effectively?

All Americans respond well to contests

Although most Americans respond to survey that they don’t like “pressure” they still like “contests” – competitions that have small rewards that don’t cause a bunch of stress. Have you ever met anyone who does not enjoy the carnival midway games of throwing darts at balloons or knocking down milk bottles with a softball? We haven’t either. What makes these fun is the simple fact that the prizes are so non-important that you are not filled with unhappiness if you lose. And successful storage staff games are the same.

Provides a sense of humor and a needed break

These type of competitions foster fun and a sense of humor. They can unite your staff and provide bonding time. They can break the doldrums with a tinge of excitement. There are many positive reasons why these type of games are good for company morale.

Tweaks the competitive spirit

Storage property performance increases with competition. When employees try harder – even if it is simply to win a prize – they put forth more effort and that means more sales and revenue for the owner. So these type of games effectively, from a dollars and cents perspective, cost the owner very little yet offer huge financial rewards. It’s basically a win/win.

Some examples

Examples of fun storage property contests could include:

You can also use these on your customers, too

Just as your staff enjoys games, so do customers. Once again, the benefits are huge and the cost is negligible. Buy a spinner like the one pictured and have every customer who rents a unit gets to spin the dial for a prize. Write the prizes on each segment of the spinner, with options like $5, a candy bar, bottle of water, etc. People love this type of entertainment.

Conclusion

Games offer staff-building, fun, and greater performance. They cost virtually nothing to use and can make you lots of money. With that in mind, game on?

If You’re Looking At Storage Deals Over $2 Million, Then Have A Professional Work With You To Obtain The Best Loan Possible

M.J. Vukovich is a capital consultant for self-storage loans. And he’s one of the best in the business. We’ve been using him for years and are firm believers that having a professional obtain and negotiate your loan is the best way to go in today’s lending environment. Here’s what a capital consultant can do for you:

- Create your loan package.

- Create the list of potential lenders based on current appetite for these type of loans.

- Meet with these lenders and obtain offers.

- Give you an array of offers and point you in the direction of the best one.

- Negotiate the terms for you.

- Shepherd the loan to completion.

All of this costs a small percentage of the loan amount and is only paid upon performance.

Call M.J. for a free consultation and discuss your lending needs and options with him at (720) 758-9227 or email him at [email protected]. You’ll be glad you did.

Don’t Let Your Marketing Get Behind the Times

We’re pretty sure that when the traffic light changes, the cars are going to win. Yet many self-storage owners are no better than that horse, living in the past and not embracing modern marketing methods. So how can you change this mentality?

Times are changing rapidly

Let’s all acknowledge that America is in a huge state of flux. Things are changing at a more rapid pace than perhaps at any other time in U.S. history. So you can no longer stick with traditional channels of marketing because the internet has changed forever how Americans shop and compare products. Would anyone even from the 1980s recognize today’s world? Probably not.

Be proactive and not reactive

The best way to market today is to be a leader and not a follower. You have to be proactive and not reactive. That means that you want to stay on the forefront of marketing trends. So watch, listen and read. See what new concepts are coming out and be a first-adopter and not the owner that doesn’t even know about the new trends until they’re already old.

Seek information from experts

You cannot possibly bluff your way into technological skills. You need to seek out expert guidance. The good news is that it’s all around you and is not very expensive to tap into. The 20 year old kid down the street – or the virtual assistant – can probably get you up to speed quickly. One of the great attributes about the internet is that it’s a young-persons’ game and they are not expensive to employ. You can find virtual assistants with a simple Google search.

No, silent movies are not coming back

The worst storage owners are the ones that refuse to accept that times have changed. They tell themselves that the internet is a fad and that it will eventually go away. Hollywood producers also said that about silent movies and they were completely wrong. Don’t waste time pretending that history repeats itself because it often doesn’t – just ask any buggy manufacturer.

Conclusion

Embrace change. Adopt the new internet marketing plans. Become gifted at getting positive on-line reviews. Read about new changes that are coming. Hire people who understand the new marketing tools and are proficient at them. Don’t fight the future – be a part of it.

Why You Should Always Keep Your Storage Facility on the Market

Warren Buffett wrote in his letter to investors a few years ago about a retail strip center he owns across from NYU. He gets offers on it all the time but has not sold it yet because the offered price has not been attractive. His theory is that you should never sell until the price offered is more than you would pay yourself – because you effectively are buying it back at that price if you decline. And that’s totally true. So how do you keep the offers flowing in to make that decision?

Pocket listings

While it’s a bad idea to put your storage facility on a visible listing with a broker on a long-term basis (as it will make your deal look shopworn and undesirable and will also scare your manager) there’s another option out there. And it’s called a “pocket listing”. That’s a situation where you instruct the broker that you’ll sell at a certain price if they have a customer, but they can’t put up any signs or list you on any MLS. You can find the right broker by seeing who in the most active in your area.

Staying alert

When you see a storage facility near you sell, it makes complete sense to contact the listing broker and to see if he has any overflow buyers who might have an interest in yours as a follow-up. That broker will already know the buyers, the prices – everything – and might have a solid offer to you in days. That’s an extremely efficient way to find a buyer.

Having the right attitude

You should always have the opinion that your property is for sale 24/7 at the right price. That’s what Warren Buffett does, and it makes complete sense. He listens to all offers and gives them serious consideration. Don’t be a storage owner that says “my property is not for sale” because that’s stupid from a business perspective. The answer should always be “my property might be for sale at the right price. What’s your offer?”

Conclusion

Your storage property should always be for sale. You should always seek out that one great offer. Fluidity in selling is what gives you the edge. Remember the old adage “buy low and sell high” and remember that “sell high” means watching for the right opportunity and you need continual offers to spot that opportunity.

Brought To You By SelfStoragesUniversity.com

If you need more information please call us (855) 879-2738 or Email [email protected]